At Bitcoin Market Journal, our investing philosophy is simple: buy and hold bitcoin, plus a small number of high-quality crypto assets, for the long term (5+ years).

This simple approach has crushed the average stock market returns (paid subscribers can see our portfolio performance here).

If you’re new to crypto investing, here are a number of ways to get started, ranked from easiest to hardest.

1) Buy and Hold

The easiest way for new investors to get involved is to simply buy some bitcoin. Using a service like Coinbase, you can purchase any amount of bitcoin – even just $100 – which gets you in the game. You’ll learn a lot from the process of buying and holding.

With about two-thirds of the market, bitcoin is still the gold standard of blockchain assets, the U.S. dollar of blockchain, so it’s probably the safest digital asset. Alternately, you can buy other digital assets, though you’ll probably want to stick with the Top 10, which have enough liquidity (i.e., buyers and sellers) if you want to sell them back for cash.

- Pros: Easy, fast, cheap.

- Cons: One-off investment; not an ongoing strategy.

2) Build a Portfolio

Better is to build a strategic portfolio that combines both traditional investments (stocks/bonds) and blockchain assets (bitcoin/altcoins/crypto ETFs).

Our Blockchain Believers Portfolio offers ready-made templates that you can use to structure your own investing portfolios. Here’s how our “Believers” portfolios (crypto investors) stack up against “Non-Believers” (traditional investors):

The basic principle is to own the entire stock market (around 60-65% of your portfolio), the entire bond market (around 30-35%), with a small slice of the pie dedicated to bitcoin and altcoins (between 2-10%).

Each month, you sock away a little bit of money into the portfolio, rebalancing twice a year so you keep the same allocation. (Set a recurring calendar appointment for January 1 and July 4.) Note this means you may need to sell your high-performing bitcoin and plow it back into boring old stocks and bonds.

- Pros: A proven long-term strategy that your financial adviser will approve.

- Cons: Takes time to set up; requires a monthly investment.

3) Invest in Blockstocks

You can also invest in companies that are investing in blockchain. These are traditional, publicly-traded stocks that are providing the “picks and shovels” to the Blockchain Gold Rush. See our Intro to Blockstocks, as well as our piece on Bitcoin Mining Stocks.

Again, you may buy and hold these stocks (see strategy #1 above), or use them as part of an overall portfolio (see strategy #2). This requires more up-front analysis of the underlying companies but doesn’t require holding bitcoin and cryptocurrencies.

- Pros: Easy to purchase through traditional trading platforms.

- Cons: Requires rigorous analysis of each stock before buying; individual stocks are not diversified.

4) Crypto Mining

Geekier investors can build custom computers, or “mining rigs,” to earn cryptocurrencies directly. While it’s hard to turn a profit by mining bitcoin, as you’re competing with so many miners, there are many other cryptocurrencies that can still make money for miners.

We have a wealth of mining content, including Best Cryptos to Mine with a PC, Building a Mining Business, Best Bitcoin Miners, Crypto Mining on a Budget, and Investing in Mining Companies.

- Pros: Lets you earn cryptocurrencies and tokens with your own computer.

- Cons: Cost of hardware, electricity, and time may eat up your profits.

5) Trading

The most difficult investing strategy, trading should be approached like a full-time job. While great fortunes can be made before breakfast, they are often lost over lunch. It’s a high-risk, high-reward lifestyle that’s best suited for those with a steel stomach and an iron will.

That said, we have expert content from real traders in both the traditional and blockchain markets, including our pieces on Best Trading Platforms, our guides to Day Trading, High-Frequency Trading, Options Trading, Margin Trading, and our popular piece on Best Bitcoin Trading Bots.

- Pros: For those with a head for math and a stomach for adventure, it can be a lucrative full-time job.

- Cons: High risk and high reward; you need money to make money.

If we’re the pioneers of bitcoin investing, this is the first map of the new frontier. These are the five strategies that have made money for investors; if you have other strategies that we’ve left off, please drop us a line. We early settlers gotta stick together.

Tips for Building Long-Term Crypto Wealth

1) Do your homework.

Successful investing takes work (there’s no free lunch). This means you must thoroughly analyze a crypto asset before you buy it. Most assets are not going to deliver superior returns over the long term, just as most stocks are not going to deliver superior returns. Your default answer should be “Pass.”

But when you find one that interests you, go deep. Study how it’s being used. Talk to people who use it. Talk with the development team. Look at its adoption rate, its potential market size, its price history. Use our free Investor Scorecard. These things will give you confidence in your winners and losers — and confidence, as we’ve seen, drives price.

Don’t invest in what you can’t explain. Don’t invest until you understand the asset well enough to describe it to your grandmother. This doesn’t mean you need to understand the technical specifics (you don’t need to understand aerospace engineering to invest in Boeing), but you do need to understand at a high level how it works.

2) Reddit is your enemy.

Reddit is an incredible site for funny GIFs of people falling downstairs, but it’s not the best place to get investing advice. The same goes for other online investment forums: there’s no entrance exam, so anyone can say any fool thing that comes into their head. It’s like peering into the mind of Mister Market.

A successful investor must bet against the market: by definition, she must be right when others are wrong. Reading “online buzz” about new digital currencies and tokens is like getting an aerial view of where all the sheep are running, so you can join them. Remember: “Reddit” rhymes with “idiot.”

3) Protect yourself against serious losses.

Do not invest more than you are willing to lose. Be willing to lose 100% if necessary, and consider it tuition you paid to learn a valuable lesson.

To protect yourself against risk, it’s best to think of digital assets as a percentage of your overall investment portfolio. Keep the majority in traditional investments like stocks and bonds, and allocate a portion (up to 20%) in blockchain opportunities: bitcoin, digital assets, and tokenized securities.

You’ll hear stories of people making all-in YOLO bets, and coming out huge winners. Ignore these stories. You won’t hear about the people who went all in and lost. People rarely relive those stories, except to their therapists.

4) Get rich slowly.

Let the crazy people try to time the market, trading in and out, buying into speculative ICOs. You’ll hear about the huge gains they achieved in just a few days. Visualize a force field that protects you from their insanity.

Guard yourself against the thinking that “I need to make 10x my money in a month.” This is gambling. The only people who get rich from gambling are casino owners and the government.

Instead, adopt the view that “I’m investing in this digital asset because I really believe in it. I’m willing to ride out the inevitable ups and downs.” Think more about marriage than a one-night stand.

5) Believe in your abilities and judgment.

Without belief in yourself, you will be subject to the whims of Mister Market. You’ll start to believe his predictions of unlimited sunshine or his fears of permanent gloom.

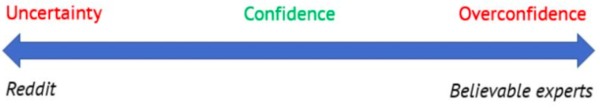

While you shouldn’t listen to online chatter, since it represents the hivemind, you should listen to the opinion of believable people with a track record of success. As Ray Dalio advises, “believable people” are:

- investors who have achieved multiple successes,

- and have a good explanation for how they did it. (They weren’t just lucky.)

Even then, however, you should take their opinion with a grain of salt, because very often the experts do not agree. Instead, look for people to challenge your ideas, to polish them up like sandpaper on wood. You don’t have to agree with the experts, but you should invite them to poke holes in your thinking. The goal is to find the truth together.

Staying away from amateur opinion builds your confidence. Being challenged by believable experts protects you from overconfidence. The sweet spot is in the middle.

6) Remember the market is never predictable.

Oh, how we long to have an algorithm that will predict the future! We want so desperately to believe that AI, or technical analysis, or elven magic, will finally tell us about the best investments before they happen.

You cannot predict how the market will behave. If this is true for the traditional stock market, this is many times more true for the digital asset market. It’s like strapping a rocket on a roller coaster.

There is one thing you can control: yourself.

You cannot control what people will say on Reddit, but you can control your response to it. You cannot control what the news media will say about the future of bitcoin, or altcoins, or your particular investment, but you can control what you do about it.

This makes long-term investing an internal game as much as an external one. You have to master your own emotions, being careful about Mister Market’s inner demons, FOMO and FUD.

TL;DR (Too Long; Didn’t Read)

- Do your homework.

- Find great opportunities at reasonable prices.

- When you believe in it, go for it. Be bold and hold.

Next Steps

If you’ve read through the above, congratulations! You have an attention span. This already sets you apart from most investors in this space. Now, dig deeper:

- Dollar-Cost Averaging: The Smart Way to Invest

- How to Open a Bitcoin Wallet, Step by Step (With Photos)

- Best Performing Cryptocurrency Funds for 2020 (With Scores!)

Subscribe to our free daily newsletter that contains the latest market-moving trends and developments.